BROKERAGE definition in the Cambridge English Dictionary

Contents:

Brokerage accounts usually have SIPC protection, which can help recover some value of such accounts if a brokerage goes under. Those investors who prefer a personal relationship and a choice of services may also want to work with a brokerage firm that’s part of their own community. They can consider a regional firm that falls between full-service brokerage firms and discount brokerage firms on the cost scale. Such companies include Raymond James, Janney Montgomery Scott, and Edward Jones.

This type of broker works on behalf of companies that are looking to borrow money. Through their knowledge and expertize, the broker will match a borrower’s requirements with the most suitable lender operating in the market. According to the NACFB, a commercial finance broker is somebody who channels funds from lenders to commercial businesses. NACFB stands for the National Association of Commercial Finance Brokers. Although most brokers work on behalf of sellers, some of them represent the buyer.

What is a Brokerage?

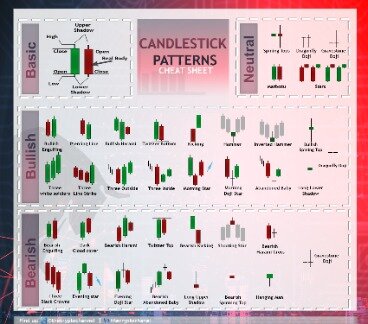

As well as executing client orders, brokers may provide investors with research, investment plans, and market intelligence. In the past, only the wealthy could afford a broker and access the stock market. Online brokering triggered an explosion of discount brokers, which allow investors to trade at a lower cost, but without personalized advice. Full-service brokers offer a variety of services, including market research, investment advice, and retirement planning, on top of a full range of investment products.

The necessity for prime brokerage arose from the growth in hedge funds. This rapid rise created a need for an intermediary, who would cater for the complex and difficult operations that are necessary for hedge fund management. Prime brokers cover the specific requirements that arise from large portfolios and certain brokers offer a more specialised service to their clients, depending on their needs and requirements.

Soon, Joanna receives an unexpected bonus at work, which she wants to invest too as a lump sum payment. After receiving advice from her broker, Joanna decides what works best for her, and makes a market order. Insurance companies may be shying away from working with businesses in this area, said Oakland broker Xavier Quan of David E. Quan Insurance Agency.

This Pioneering Economist Says Our Obsession With Growth Must End – The New York Times

This Pioneering Economist Says Our Obsession With Growth Must End.

Posted: Mon, 18 Jul 2022 07:00:00 GMT [source]

In these societies, brokerage linked citizens and elites via informal, voluntary, and asymmetrical relationships and was part of a broader system of political clientelism. Finally, studies of ethnicity highlighted brokerage links between ethnic groups. Brokers who are employed by discount broker firms may work as over-the-phone agents available to answer brief questions, or as branch officers in a physical location. They also may consult with clients subscribing to premium tiers of the online broker. A stockbroker is a professional intermediary on stock or commodity markets who sells and buys assets in the interest of the client on the most favorable terms. The three types of brokerage are online, discount, and full-service brokerages.

Brokerage Accounts With a Regional Financial Advisor

#WTFact Videos In #WTFact Britannica example of broker some of the most bizarre facts we can find. S to direct trades their way — were the subject of a widespread, misleading theory tying Robinhood with Citadel. Firm’s biggest brand campaign to date, peddles the idea that everyone is an investor.

Today, many stockbrokers have transitioned to financial advisors or planners as online brokerage platforms allow users to enter their own orders via the web or mobile app. Brokerage firms and broker-dealer companies are also sometimes referred to generically as stockbrokers. These include both full-service brokers and discount brokers, who execute trades but do not offer individualized investing advice. Full-service brokerages offer additional services, including advice and research on a wide range of financial products. A stockbroker is a regulated representative of the financial market who enables the buying and selling of securities on behalf of financial institutions, investor clients, and firms. A stockbroker is also called a registered representative or a broker.

Meaning of brokerage in English

Personal https://trading-market.org/rs and investors utilize the assistance of exchange members since stock markets cannot accept orders from persons or organizations that are members of the exchange. Financial Product A financial instrument is any asset or bundle of assets that can be traded. Asset Classes Asset classes are groups of financial assets, such as shares or bonds, which have been… Portfolio Management Looking for a portfolio management definition? Some financial institutions offer both discount and full-service brokerage accounts.

That is impossible in a market that has a huge number of participants making transactions at split-second intervals. A broker is a middleman who connects those who want to trade and invest with the exchange where those trades are executed. Because stock exchanges require that persons who conduct trades on the exchange be licensed, you’ll need a broker.

DRIPs use a technique calleddollar-cost averaging intended to average out the price at which you buy stock as it moves up or down over a long period. You are never buying the stock right at its peak or at its low with dollar-cost averaging. They represent both retail and institutional clients either through a stock exchange or over the counter. Insurance brokers or insurance agents sell, solicit, or negotiate insurance for compensation.

What Is a Brokerage Account? Definition, How to Choose, and Types – Investopedia

What Is a Brokerage Account? Definition, How to Choose, and Types.

Posted: Fri, 24 Feb 2023 08:00:00 GMT [source]

A forex broker is an intermediary who provides access to the forex currency market. Since the forex market is open only to a certain number of organizations, access to it for individuals is possible only through the mediation of forex brokers. Operations on the exchange market are difficult for outsiders and require a certain number of special approvals and permissions to finalize transactions. It is useful to address professional participants on a stock exchange, such as to brokers.

Cash Brokerage Accounts

Full-service brokers provide execution services as well as tailored investment advice and solutions. Discount brokers execute trades on behalf of a client, but typically don’t provide investment advice. People who use full-service brokers want the advice and attention of an expert to guide their financial affairs. These are usually complex, as these clients tend to be high-net-worth individuals with complex financial affairs. They are willing and able to pay an average of 1% to 3% of their assets per year for the service.

One of the essential characteristics of the brokerage interaction was its exceptional, often individualistic nature. The further development of brokerage arrangements and care management may help to surmount these difficulties. One last housing example, besides demonstrating yet another type of collective brokerage interaction, suggests part of that logic. In the late seventeenth century, it was quite probably through word of mouth and the brokerage of local attorneys. Specialty CDs offer features such as the ability to add to the principal or avoid early withdrawal fees.

A broker is the intermediary between an investor or trader and securities exchange. Brokers are the facilitators of liquidity in the financial system, and key players in the markets. Using margin can end in a financial disaster, no matter how confident you are in a trade. You can ultimately lose much more money than you initially invest, whereas, with a cash account, you can only lose the money you deposit into the account. A poor decision in a volatile market can land a trader in debt, and they’ll be on the hook for contributing more money into their margin account just to settle that debt. Brokerage accounts are the more basic alternative to retirement investment accounts, like 401 plans and Roth IRAs.

That’s why we offer tons of free resources to help you make it a little less crazy. Explore our collections of guides on management, marketing, finance, human resources, digital marketing, and personal management. Registered investment advisors are the most common type of independent broker found today. The introduction of the first discount brokerage is often attributed to Charles Schwab Corp., which launched its first website in 1995.

You will likely be required to hold a certain amount of equity or collateral for the borrowed shares, too. If the stock price goes up too much, your brokerage may force you to cover the short and buy back shares or deposit more cash as equity . Many investors opt to open an account with an online broker, which may charge lower fees.

Many online brokers now charge no commission to buy or sell stocks and other investments. Most discount brokerages now offer their customers zero-commission stock trading. A full-service stockbroker offers a variety of financial services to clients.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- Discount stockbrokers offer more research tools and trading options with smaller commissions; hence, they attract active day traders and investors.

- Discount brokers would typically charge less, but won’t provide advice, or provide it at an additional cost.

- You can have as many or few brokerage accounts as you want, unless an institution chooses not to allow you to open a brokerage account.

He has covered financial topics as an editor for more than a decade. Before joining NerdWallet, he served as senior editorial manager of QuinStreet’s insurance sites and managing editor of Insure.com. In addition, he served as an online media manager for the University of Nevada, Reno. He has covered investing and financial news since earning his economics degree from the University of Maryland in 2016. Sam has previously written for Investopedia, Benzinga, Seeking Alpha, Wealth Daily and Investment U, and has worked as an editor for Investment U, Wealth Daily and Haven Investment Letter.

A resulting margin call for additional money may be difficult for you to meet. Brokers can sell securities in your account to meet the call if you don’t deposit the funds. Remember, to open an account, you have to have selected the brokerage that suits your needs.

More from Merriam-Webster on stockbroker

The process is similar to opening a checking account with a bank. Someone who wants a brokerage account files an application with a brokerage firm. The application will ask for basic personal information, such as your name, address, and Social Security number. Some investors and fund management companies lend shares to take advantage of the interest paid by the borrower. They may lend out stocks owned in an exchange-traded fund and use the proceeds to reduce annual expenses for investors.

What Is a Broker? Definition, Examples and How to Find One – NerdWallet

What Is a Broker? Definition, Examples and How to Find One.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

A broker is an intermediary between those who want to make trades and invest and the exchange in which those trades are processed. You need a broker because stock exchanges require that those who execute trades on the exchange be licensed. Another reason is a broker ensures a smooth trading experience between an investor and an exchange and, as is the case with discount brokers, usually won’t charge a commission for normal trades. The online broker who offers free stock trades receives fees for other services, plus fees from the exchanges. For regular stock orders, full-service brokers may charge up to $10 to $20 per trade. However, many are switching to a wrap-fee business model in which all services, including stock trades, are covered by an all-inclusive annual fee.

With over 5,000 marketing guides and other resources, you’ll never have trouble finding what you need to study. Learn leadership from scratch including different leadership styles, skills you should adapt, and examples of great leaders. With 150+ videos, our mega management course is designed to help you learn management skills.

Different types of assets have different levels of coverage, and some—like commodities—have no coverage at all. The interest rate you pay to borrow the shares is determined when the shares are borrowed. The rate is determined by borrowing demand, short selling, and market conditions. Institutional investors such as open- and closed-end funds, insurance companies, pension plans, and college endowments usually participate in securities lending. This allows them to lend out portions of their portfolios to generate income.