What Are the Benefits of Using a CFD Trading Platform for Your Investments?

CFD trading, or Contract for Difference trading, allows you to speculate on the rising or falling prices of fast-moving global financial markets or instruments such as shares, indices, commodities, currencies, and treasuries. It provides an opportunity to trade with leverage, which means you can gain a large exposure to a financial market for a relatively small initial deposit. CFD trading is a popular method among investors due to its flexibility and potential for high returns.

Key Advantages of CFD Trading Platforms

CFD trading platforms offer several advantages that attract both novice and experienced traders. Here are some key benefits:

- Leverage: CFD trading allows traders to use leverage, which means they can open larger positions with a smaller amount of capital. This can significantly amplify profits.

- Short Selling: Unlike traditional stock trading, CFDs allow you to sell short. This means you can profit from falling markets as well as rising ones.

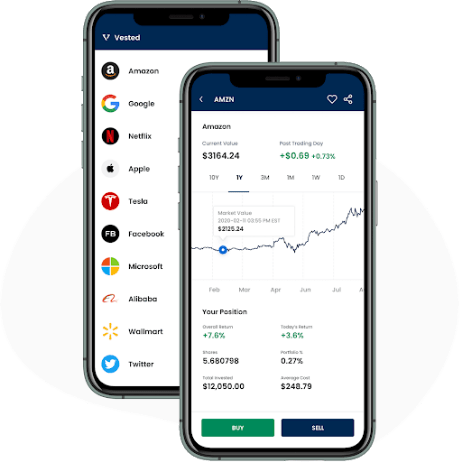

- Diverse Market Access: CFD platforms provide access to a wide range of markets, including stocks, forex, commodities, and indices. This diversity helps in spreading risk and maximizing potential returns.

- No Stamp Duty: In some regions, trading CFDs exempts you from paying stamp duty, which can result in cost savings.

Choosing the Right CFD Trading Platform

Selecting the right Best Cfd Trading Platform is crucial for a successful trading experience. Factors to consider include:

- User Interface: A user-friendly interface is essential for efficient trading. Look for platforms that offer intuitive navigation and easy access to tools and features.

- Charting Tools: Advanced charting tools help in analyzing market trends and making informed decisions. Ensure the platform provides robust charting capabilities.

- Regulation: It’s important to choose a platform that is regulated by reputable financial authorities to ensure your investments are protected.

- Customer Support: Reliable customer support can assist you with technical issues and trading inquiries, enhancing your overall experience.

Why Should You Use the MetaTrader 5 Platform for CFD Trading?

Introduction to MetaTrader 5

MetaTrader 5 (MT5) is a multi-asset trading platform that allows trading Forex, stocks, and futures. Developed by MetaQuotes Software, MT5 is an upgraded version of MetaTrader 4 (MT4), offering advanced trading functions, analytical tools, and more. It is widely recognized for its comprehensive features and flexibility.

Key Features of MetaTrader 5

MetaTrader 5 stands out due to its extensive features that cater to both beginners and professional traders. Some of the key features include:

- Multi-Asset Platform: MT5 supports trading on various financial markets, making it a versatile choice for traders.

- Advanced Analytical Tools: The platform offers over 80 built-in technical indicators and analytical tools, aiding in market analysis and decision-making.

- Automated Trading: MT5 allows the use of automated trading strategies through Expert Advisors (EAs). Traders can develop, test, and apply EAs to automate their trading processes.

- Economic Calendar: An integrated economic calendar provides real-time information on economic events and news, helping traders stay informed about market movements.

Advantages of Using MetaTrader 5 for CFD Trading

MetaTrader 5 offers several advantages that make it an ideal platform for CFD trading:

- Enhanced Trading Tools: MT5 provides a wide range of tools for technical analysis, including 21 timeframes and multiple chart types. These tools help traders make precise trading decisions.

- Algorithmic Trading: With its built-in MQL5 development environment, traders can create and test their own trading robots and technical indicators, enhancing their trading strategies.

- Improved Order Management: MT5 offers advanced order management capabilities, allowing traders to place and manage orders more efficiently.

- Flexibility: The platform supports various order types and execution modes, offering flexibility to implement different trading strategies.

Setting Up MetaTrader 5 for CFD Trading

Getting started with MetaTrader 5 for CFD trading involves a few simple steps:

- Download and Install: Download the MetaTrader 5 software from the official MetaQuotes website or your broker’s website. Follow the installation instructions to set up the platform on your device.

- Create an Account: Open a trading account with a broker that supports MT5. Complete the registration process and fund your account.

- Configure the Platform: Customize the platform settings according to your preferences. Set up your trading environment by adding the desired financial instruments, charts, and indicators.

- Start Trading: Begin trading by placing orders through the platform. Use the analytical tools and features to monitor the markets and execute your trading strategies.

Exploring the Potential of CFD Trading with MetaTrader 5

Utilizing Analytical Tools for Better Decision Making

MetaTrader 5 offers a plethora of analytical tools that can enhance your trading performance. The platform’s advanced charting capabilities allow you to visualize market trends and identify potential trading opportunities. You can use technical indicators, such as moving averages, MACD, and RSI, to gain insights into market movements.

Leveraging Automated Trading for Efficiency

One of the standout features of MetaTrader 5 is its support for automated trading. By developing and using Expert Advisors (EAs), you can automate your trading strategies, reducing the need for constant monitoring and manual execution. Automated trading can help you take advantage of market opportunities even when you are not actively trading.

Risk Management with MetaTrader 5

Effective risk management is crucial in CFD trading. MetaTrader 5 provides several tools to help you manage risk, including:

- Stop Loss and Take Profit Orders: These orders allow you to set predetermined levels at which your position will be closed, helping to limit potential losses and secure profits.

- Trailing Stops: A trailing stop order adjusts automatically as the market price moves in your favor, locking in profits while minimizing risk.

- Margin and Leverage: The platform provides detailed information on margin requirements and leverage, enabling you to manage your positions more effectively.

Customizing the Trading Environment

MetaTrader 5 allows extensive customization of the trading environment to suit your individual needs. You can create multiple profiles with different layouts, set up custom indicators, and develop personalized trading strategies. This flexibility ensures that the platform adapts to your trading style.

Conclusion: Enhancing Your CFD Trading Experience with MetaTrader 5

The MetaTrader 5 platform offers a comprehensive suite of features that can significantly enhance your CFD trading experience. Its advanced analytical tools, support for automated trading, and robust risk management capabilities make it a powerful choice for traders. By leveraging the benefits of MetaTrader 5, you can improve your trading performance and achieve your investment goals more effectively.

Whether you are a novice trader looking to get started or an experienced trader seeking advanced tools, MetaTrader 5 provides the flexibility and functionality to meet your needs. With its user-friendly interface and extensive customization options, MT5 stands out as a leading platform for CFD trading.

Start your CFD trading journey with MetaTrader 5 today and experience the advantages of a sophisticated trading platform designed to help you succeed in the dynamic world of financial markets.